- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- ILM Level 4 Assignment 01: Developing Leadership Styles: An Action Plan for Effective Leadership and Team Engagement

- Level 6 Unit T/615/2726 Assignment: Strategic Project Management: Identifying, Planning, and Controlling Projects for Business Success

- EDD-U1-T4 Assignment: Internal and External Support Services for Educational Practitioners

- Discussion Paper on Market Forces and Government Interventions for Business Leaders

- Unit 10 Customer Relationship Management Assignment – CRM Processes & Stakeholder Roles

- CIPD 7HR02 Resourcing and Talent Management to Sustain Success

- Athe Level 3 Health and Social Care Assessment Questions

- M/618/4168 Unit 2 Principles, Values and Regulation in the Health and Social Care Sector – ATHE Level 3

- ILM Communication Skills Self-Assessment

- ILM Unit 8600-309: Understand How to Establish an Effective Team

- CMI Unit 525 Using Reflective Practice to Inform Personal and Professional Development

- Understand and Work with a Wide Range of Stakeholders and Organisational Structures – Assignment 1

- Assessment: Financial Performance Evaluation of Savory Snacks Company Ltd for Credit

- CMI L5 Assignment: Managing Stakeholder Relationships: Strategies, Challenges, and Best Practices

- Level 3 Unit 2 Assignment: Principles, Values and Regulation in the Health and Social Care Sector

- COM4006 Assignment: Introduction to Academic Skills and Professional Development

- Assessment: Managing Organisational Change: Evaluating Strategies, Challenges, and Impact

- UNIT CMI 706 Assignment: Finance for Strategic Leaders: The Role, Scope, and Impact of Finance

You are a junior accountant in a small accountancy firm and you have been asked to prepare and produce a range of final accounts: Financial Accounting Assignment, CTIC,UK

| University | Chindwin Tu International College (CTIC) |

Scenario

You are a junior accountant in a small accountancy firm and you have been asked to prepare and produce a range of final accounts for a number of different businesses. You have been provided with a range of individual company’s financial details from which to create a general ledger, a trial balance, income statement and balance sheet. You will need to make adjustments as required and once the general ledger is completed. Once completed you will present to your line manager a portfolio of final accounts that includes a reflective summary that compares the different types of accounts produced.

You should cover the following in the introduction:

- What is financial accounting.

- Explain the difference between accounting and book-keeping.

- What is a business transaction?

Part 1

Record business transactions using double-entry book-keeping, and be able to extract a trial balance.

- 1, 2020, Mr Mason Brown started business with Cash $40,000.

- 3, he paid into the Bank $2,000.

- 5, he purchased goods for cash $15,000.

- 8, he sold goods for cash $6,000.

- 10, he purchased furniture and paid by cheque $5,000.

- 12, he sold goods to Mary $4,000 by credit.

- 14, he purchased goods from John $10,000.

- 15, he returned goods to John $5,000.

- 16, he received from Mary $3,960 in full settlement.

- 18, he withdrew goods for personal use $1,000.

- 20, he withdrew cash from business for personal use $2,000.

- 24, he paid telephone charges $1,000.

- 26, cash paid to John in full settlement $4,900.

- 31, paid for stationary $200, rent $ 500 and salaries to staff $2,000.

Do You Need Assignment of This Question

Required;

- Apply the double entry book-keeping system of debits and credits. Record sales and purchases transactions in journal and a general ledger for the year 31 Dec 2020.

- Produce a trial balance as at 31 Dec 2020 by applying the use of the balance off rule to complete the ledger.

- Analyse sales and purchase transactions to compile a trial balance using double entry bookkeeping appropriately and effectively.

- Apply trial balance figures to show which statement of financial accounts they will end up in.

Part 2

Prepare final accounts for sole-traders, partnerships and limited companies in accordance with appropriate principles, conventions and standards.

Prepare final accounts for sole-traders

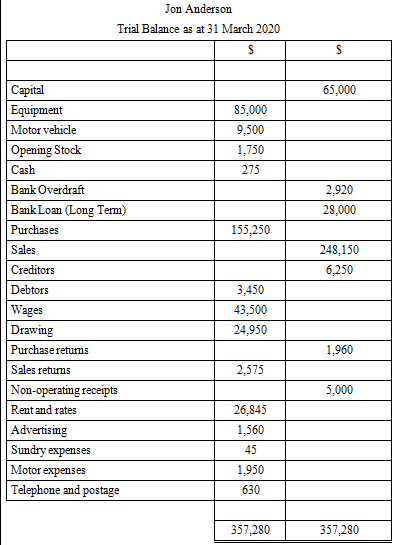

The following trial balance was extracted from the books of Jon Anderson, a sole trader at the close of the business on 31 March 2020.

Prepare a trading, profit and loss and appropriation account for the year and a balance sheet as at the end of the year for a sole trader. Take the following into account:

Addition Information:

Closing Stock $2,350

Depreciation on Straight-line Method Basis

Equipment 15% on Cost

Motor Vehicle 20% on Cost

Prepare final accounts for Partnerships

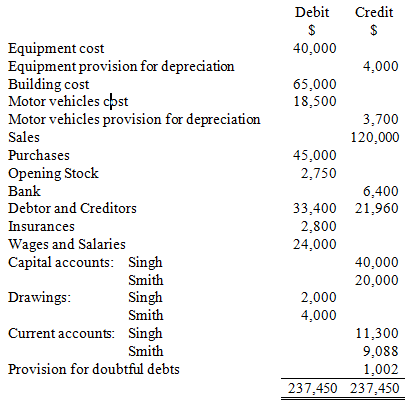

Mrs. Singh and Mr. Smith are in partnership and share profits and losses 2:1. A draft Trial Balance has been extracted from the partnership books of account at the end of the year, 31 December 2020

Buy Answer of This Assessment & Raise Your Grades

There are a number of items that need to be taken into consideration

- Depreciation is to be provided at 10% straight-line on equipment and 25% reducing balance on motor vehicles

- Closing stock is valued at $3,000.

- Insurance of $400 is prepaid and wages of $800 are to be accrued.

- The provision for doubtful debts is to be increased to 5% of debtors.

- Interest on drawings is charged at 5% p.a. on the balance in the trial balance.

- Interest on capital is allowed at 7%.

- Smith receives a salary of $4,000.

Required :

Prepare the Partnership Trading and Profit & Loss Account for the year ended, the Partnership Appropriation Account for the year ended and the Partners’ Current Accounts at 31 December 2020.

Prepare final accounts for Limited company

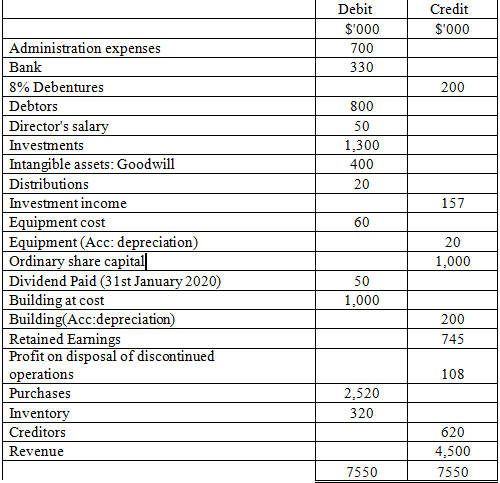

You are a business manager with Walker Brother Limited, a sportswear manufacturer producing mainly running wear. Your director has asked you to produce the draft financial statements for the year ended 31 July 2020, based on the trail balance below, which have been extracted from the accounting system and the information in the notes to the accounts.

Trial Balance for Walker Brother Limited at 31 July 2020

Notes to the accounts

- Inventory at 31 July 2020 was valued at $250,000.

- The following expenses were still outstanding

Administration costs $2,000

Director’s salary $6,000

- The Distribution costs include a prepayment $3,000 relating to the following year.

- Depreciation is to be charged on:

Building $100,000

Equipment $8,000

- Corporation tax charge on profits for the year is estimates to be $ 95,000

- Debenture interest is outstanding at the year-end.

Required:

- You are required to produce finals account Income Statement and Balance Sheet for Walker Brother Limited at 31 July 2020

- Make adjustments to balances of sum accounts for example, accruals, depreciation and prepayments before preparing the final accounts.

Compare the essential features of each financial account statement to analyze the differences between them in terms purpose, structure and content.

Are You Looking for Answer of This Assignment or Essay

Looking for report writing help in the UK? Look no further than Diploma Assignment Help UK. We offer a wide range of report writing services, from simple report writing to more complex projects. Our team of expert writers can handle any report writing assignment, big or small. Contact us today to learn more about our assignment writing services.