- EG6026 Transport Infrastructure Engineering Assignment 1 Individual Coursework | UOEL

- TEFL Assignment: Analyzing Tenses, Punctuation Usage, and Effective Teacher-Student Communication

- EEE8089 Assignment: Raspberry Pi Network Architecture and Remote Access Configuration

- ILM Unit-409: focused on understanding the impact of development on workplace performance: Managing Personal Development, Coursework, UOS, UK

- ILM Unit-409: focused on implementing and evaluating planned development activities and apply learning in the workplace: Managing Personal Development, Coursework, UOS, UK

- ILM Unit-409: focused on identifying and prioritising work-related development requirements: Managing Personal Development, CourseWork, UOS, UK

- 7PS032: Identify type of study design needed, including within or between groups where relevant: Research Methods Course Work, UOW, UK

- 7PS032: What do the means, range and standard deviations show?: Research Methods Course Work, UOW, UK

- 7PS032: You need to write a research proposal. It must be a quantitative research proposal: Research Methods Course Work, UOW, UK

- MN0493: Report the major points of your discussions with the client. This should include the construction of the portfolios: Investments and Risk Management Course Work, NUN, UK

- DAT7303: In portfolio 3, students must complete 4 tasks related to analysing a dataset using CRISP- DM methodology: Data Mining Course Work, UK

- BUSI 1475: Your task is to identify and select an article from the BBC News website (news.bbc.co.uk): Management in a Critical Context Course Work, UOG, UK

- COMP6029: Computer Science and Electronic Engineering related subjects generally use the IEEE referencing style: Network Systems Course Work, UOS, UK

- UMACTF-15-M: You have recently been appointed as a Financial Analyst for a leading investment bank in London: Corporate Financial Strategy Course Work, UWE, UK

- BAM5010: choose an organisation and make some recommendations for the delivery: Work Based Project Course Work, UOB, UK

- You are required to calculate ratios for Fresh Farms Ltd: financial Course Work, UK

- Understand the legal, ethical and theoretical context for health, safety and risk management: leadership and Management Course Work, UK

- P3 Describe the types of training and development used by a selected business: BTEC Business Extended Diploma Pearson Course Work, UK

- Describe how a selected business identifies training needs: BTEC Business Extended Diploma Pearson Course Work, UK

- Discuss your chosen business, background information and why you have chosen that business: BTEC Business Extended Diploma Pearson Course Work, UK

The global M&A; market remained strong in 2018 with announced transaction volumes reaching $4.1 trillion, the third-highest year: Corporate Finance Coursework, QMUL, UK

| University | Queen Mary University of London (QMUL) |

| Subject | Corporate Finance |

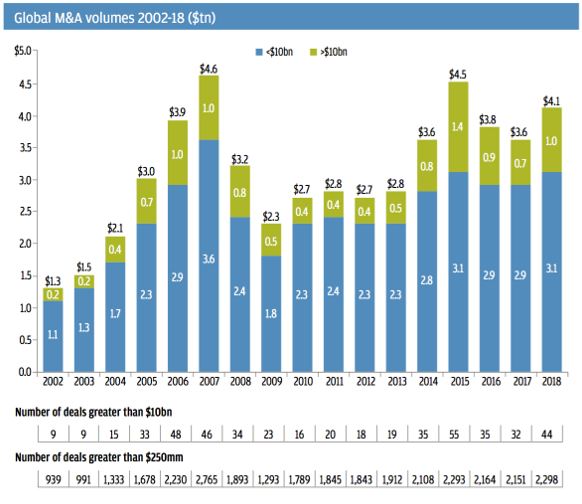

The global M&A; market remained strong in 2018 with announced transaction volumes reaching $4.1 trillion, the third-highest year ever for M&A; volumes. The announced volume in the first half of 2018 was robust, representing the second-highest first half of all time. The activity was largely driven by “megadeals”.

Thirty megadeals were announced in the first six months of 2018 — the highest first-half megadeal count on record — compared with 14 deals in the first half of 2017. The number of megadeals began to normalize throughout the second half of the year, although they continued to be a significant driver of activity in 2018.

While megadeals were a large driver of M& A-announced dollar volumes in 2018, the count for deals greater than $250 million also increased by 7% from 2017, with activity remaining robust across all deal types. The activity was brisk across domestic and international deals, strategic and private equity, and all sectors, with technology and healthcare representing the largest contributors to global volume in 2018. Private equity funds continued to have ample “dry powder” and deployed this capital throughout 2018; sponsor buy-side volume was up 9% YOY.

Several of the key drivers and catalysts of M&A; A have continued from prior years. Positive global growth, improving cash flows, strengthening balance sheets, low cost of debt, investor support, and CEO confidence all continued to boost M&A; activity. The biggest new tailwind this year was the implementation of tax reform in the U.S., which helped generate incremental cash flows and provided access to overseas funds.

Innovation, disruption, and the need for growth also contributed to M&A activity, driving change across industries, geographies, and organizations. An accelerating rate of disruption has driven the need to act with urgency. As a result, new consumption patterns, new platforms, and new business models are resetting the basis of competition, redistributing industry economics, and reallocating value. We’ve seen a drastic increase in the technology sector over the past decade, more than doubling its share of the overall M&A market as the sector continues to innovate to meet changing demands.

While geopolitical uncertainty was prominent throughout the year and created many headlines, it had a limited effect on deal volumes in the first half of the year but may have contributed to the deceleration of activity toward the end of 2018. Meanwhile, cross-border M&A volume remained strong, accounting for 30% of the total M&A market, but with a different mix: China’s outbound M&A continued to decline, while Japan’s outbound M&A was robust throughout the year, with a record $184 billion in announced volume and a record number of deals larger than $1 billion. However, Japan’s activity benefitted disproportionately from Takeda Pharmaceutical’s acquisition of Shire for $81 billion.

Are You Looking for Answer of This Assignment or Essay

UK students enrolled at Queen Mary University of London (QMUL) can benefit from our exceptional academic services. We specialize in providing Finance Assignment Help and reliable assignment writing help specifically tailored to the field of Corporate Finance. Whether you need assistance with your Corporate Finance Coursework or any other related assignments, our team of experts is here to support you. In an era where the global M&A market continues to thrive, with transaction volumes reaching $4.1 trillion in 2018, it is crucial to understand the complexities of corporate finance. By paying for our services, you can access the expertise of our skilled professionals, ensuring excellence in your coursework. Trust us to assist you on your academic journey and help you achieve remarkable results in the field of finance at QMUL in the UK.