- EG6026 Transport Infrastructure Engineering Assignment 1 Individual Coursework | UOEL

- TEFL Assignment: Analyzing Tenses, Punctuation Usage, and Effective Teacher-Student Communication

- EEE8089 Assignment: Raspberry Pi Network Architecture and Remote Access Configuration

- ILM Unit-409: focused on understanding the impact of development on workplace performance: Managing Personal Development, Coursework, UOS, UK

- ILM Unit-409: focused on implementing and evaluating planned development activities and apply learning in the workplace: Managing Personal Development, Coursework, UOS, UK

- ILM Unit-409: focused on identifying and prioritising work-related development requirements: Managing Personal Development, CourseWork, UOS, UK

- 7PS032: Identify type of study design needed, including within or between groups where relevant: Research Methods Course Work, UOW, UK

- 7PS032: What do the means, range and standard deviations show?: Research Methods Course Work, UOW, UK

- 7PS032: You need to write a research proposal. It must be a quantitative research proposal: Research Methods Course Work, UOW, UK

- MN0493: Report the major points of your discussions with the client. This should include the construction of the portfolios: Investments and Risk Management Course Work, NUN, UK

- DAT7303: In portfolio 3, students must complete 4 tasks related to analysing a dataset using CRISP- DM methodology: Data Mining Course Work, UK

- BUSI 1475: Your task is to identify and select an article from the BBC News website (news.bbc.co.uk): Management in a Critical Context Course Work, UOG, UK

- COMP6029: Computer Science and Electronic Engineering related subjects generally use the IEEE referencing style: Network Systems Course Work, UOS, UK

- UMACTF-15-M: You have recently been appointed as a Financial Analyst for a leading investment bank in London: Corporate Financial Strategy Course Work, UWE, UK

- BAM5010: choose an organisation and make some recommendations for the delivery: Work Based Project Course Work, UOB, UK

- You are required to calculate ratios for Fresh Farms Ltd: financial Course Work, UK

- Understand the legal, ethical and theoretical context for health, safety and risk management: leadership and Management Course Work, UK

- P3 Describe the types of training and development used by a selected business: BTEC Business Extended Diploma Pearson Course Work, UK

- Describe how a selected business identifies training needs: BTEC Business Extended Diploma Pearson Course Work, UK

- Discuss your chosen business, background information and why you have chosen that business: BTEC Business Extended Diploma Pearson Course Work, UK

BF2269: Apply the Conceptual Framework for Financial Reporting and International Financial Reporting Standards: International Financial Reporting Coursework, AU,UK

| University | Aston University (AU) |

Module Learning Outcomes Assessed:

- Apply the Conceptual Framework for Financial Reporting and International Financial Reporting Standards (IFRS) to enable an accurate assessment of accounting issues and be able to offer a solution, with justification to financial reporting issues. Be able to articulate these complex issues in varied formats including those commonly used in professional communication – letters, emails reports etc.

- Develop the ability to use professional judgement on subjective areas of the financial statements in readiness for placement and final year studies.

- Critically assess the impact of judgement on financial statements and other reports taking into consideration the different perspectives of the users of the financial statements and their information needs.

- Prepare financial statements.

Generally it is expected that:

- Tasks will be properly presented

- Narrative tasks will address the issues identified and use relevant IFRS Standards and refer to the IASB’s Conceptual Framework for Financial Reporting.

- Calculative elements will be well laid out and have clarity in the answers provided.

TASK 1

The accounts team have been preparing the financial statements for Wail

ltd for the year ended 31 May 2021. The draft financial statements are shown below:

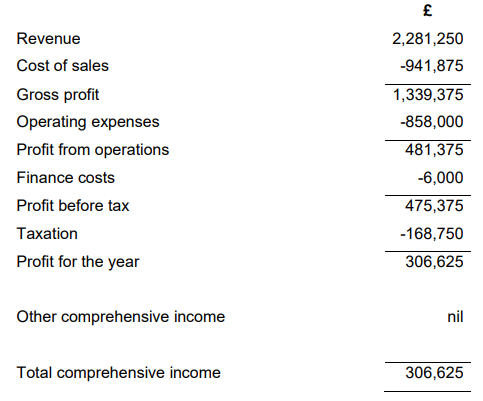

Draft statement of profit or loss and other comprehensive income for

Wail ltd for the year ended 31 May 2021: £

Draft statement of financial position for Wail ltd as at 31 May 2021:

Do You Need Assignment of This Question

Additional information:

- Wail ltd purchased a brand from one of its competitors on 1 December 2020 for £71,250. Wail Ltd expect the brand to have a useful life of five years and intends to sell it after five years. Wail ltd estimates that the value of the brand will increase in value over the five years and so no amortization has been accounted for in the current year. Wail Ltd.’s policy is to charge depreciation/amortization on a proportionate basis.

- On 1 March 2021 Wail ltd received a government grant of £40,000 to help finance the acquisition of a machine with a five-year useful life. The machine was purchased on the same date for £90,000 and was correctly recognized in property, plant and equipment on 1 March 2021. No further adjustments have been made in respect of the plant. The grant received of £40,000 was been credited to revenue.

- The accounts team have subsequently discussed the grant and have decided that Wail ltd.’s accounting policy for government grants will be to use the deferred income approach. However, no further adjustments have been made to the draft financial statements in respect to the accounting of the grant.

- In April 2021 a group of customers started a legal action against Wail

ltd, claiming £100,000 in damages, plus estimated costs of £15,000. Wail ltd’s legal advisers assess the probability of the claim being successful at around 30%. Wail ltd has recognised £34,500 in operating expenses (being 30% of the total estimated cash outflow – £115,000 x 30%). - On 1 June 2020, Wail Ltd had 200,000 £1 shares in issue. On 1 June 2020 Wail ltd issued 25,000 £1 ordinary shares for cash of £2.40 each. The full amoun received was debited to cash and credited to ordinary share capital (included in the draft financial statements). On 1 February 2021, a 1 for 4 bonus issue of ordinary shares was made. No accounting entries have been made for the bonus issue. Wail Ltd wishes to utilise the share premium account as far as permitted under statute. Wail ltd also paid a dividend on 1 March 2021 of 10p per share. The full amount was paid and debited to operating expenses and credited to cash.

TASK 2

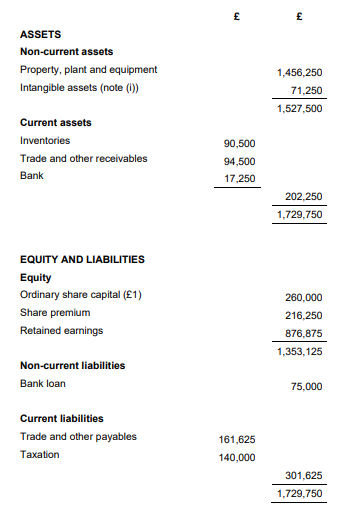

Jotta & Co ltd (Jotta) began trading as a family run business 30 years ago and operates a chain of do it yourself (DIY) stores. Jotta’s management has not changed since it began, and its stores maintain a traditional DIY store layout. Customers can purchase DIY items such as decorating, plumbing and electrical equipment. Jotta sells its DIY items to both wholesale and retail customers and has a higher proportion of wholesale sales than the rest of the sector. Extracts from the financial statements of Jotta for the year ended 31 May 2021 are shown below:

The following information is relevant:

- Jotta has faced increasing competition in recent years from other DIY

stores that have diversified their business and sell other products in their stores including lighting and soft furnishings. In addition to this, these stores have facilities that attract customers, such as coffee shops (run by third parties). - As a result of the increasing competition, the directors of Jotta have

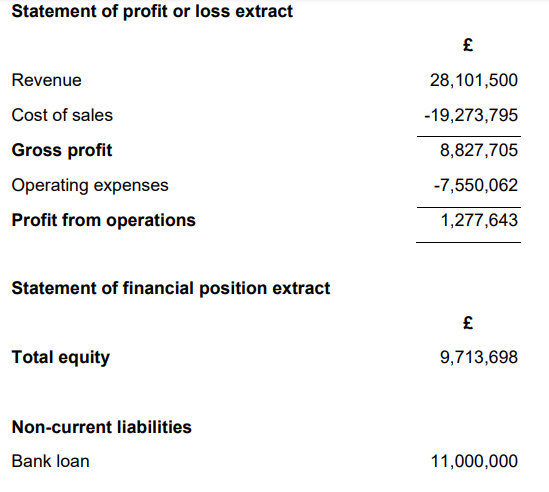

recently decided to undertake some store refurbishment, rebranding and website maintenance. Jotta ltd has taken out additional bank loans to finance these activities in the current financial period - The company has recently subscribed to an agency that produces sector ratios. The agency has supplied the following ratios for the DIY sector for the year ended 31 May 2021:

- Gross profit margin 35.6%

Operating profit margin 6.3%

Return on capital employed (ROCE) 12.4%

Gearing (debt/equity) 50% - (4) Jotta owns some of its DIY stores. These stores are recognised within

property, plant and equipment at a cost of £13 million (land £5 million). Accumulated depreciation of £2.4 million had been charged on the

buildings by 31 May 2020 (last year). Buildings are currently +depreciated on a straight-line basis over 50 years. Jotta accounts for its properties using the cost model in IAS 16 Property, Plant and equipment and includes depreciation on buildings within cost of sales. Jotta had its properties professionally valued at the start of the year for financing purposes at £15.3 million (land £7 million) as at 1 June 2020 and that they had an average remaining life of 40 years on this date. This valuation had not been incorporated in Jotta’s financial statements. Jotta has similar accounting policies to the rest of the sector except for its properties. The agency has informed Jotta that the rest of the sector use the revaluation model for its properties.

Buy Answer of This Assessment & Raise Your Grades

Looking for the best CIPD assignment help in the UK? Look no further than Diploma Assignment Help UK. We provide comprehensive assignment writing services for students who need help with their CIPD assignments. Our team of professional and experienced writers understands the nuances of the CIPD syllabus and can craft excellent assignments that are sure to impress your professor. So contact us and get the best possible solution!