- Level 6 Unit T/615/2726 Assignment: Strategic Project Management: Identifying, Planning, and Controlling Projects for Business Success

- EDD-U1-T4 Assignment: Internal and External Support Services for Educational Practitioners

- Discussion Paper on Market Forces and Government Interventions for Business Leaders

- Unit 10 Customer Relationship Management Assignment – CRM Processes & Stakeholder Roles

- CIPD 7HR02 Resourcing and Talent Management to Sustain Success

- Athe Level 3 Health and Social Care Assessment Questions

- M/618/4168 Unit 2 Principles, Values and Regulation in the Health and Social Care Sector – ATHE Level 3

- ILM Communication Skills Self-Assessment

- ILM Unit 8600-309: Understand How to Establish an Effective Team

- CMI Unit 525 Using Reflective Practice to Inform Personal and Professional Development

- Understand and Work with a Wide Range of Stakeholders and Organisational Structures – Assignment 1

- Assessment: Financial Performance Evaluation of Savory Snacks Company Ltd for Credit

- CMI L5 Assignment: Managing Stakeholder Relationships: Strategies, Challenges, and Best Practices

- Level 3 Unit 2 Assignment: Principles, Values and Regulation in the Health and Social Care Sector

- COM4006 Assignment: Introduction to Academic Skills and Professional Development

- Assessment: Managing Organisational Change: Evaluating Strategies, Challenges, and Impact

- UNIT CMI 706 Assignment: Finance for Strategic Leaders: The Role, Scope, and Impact of Finance

- ENGINEERING DESIGN TMA2 v1: CAD Design Report: Specification, Evaluation & Drawings

- Unit CMI 514 Assignment: Analysis of Organisational Change: Managing Change

- EMS402U TMA1: Engineering Design Solutions: Concept Development & Assessment

Below is the trial balance for Petronella Ltd as of 31 December 2022. Petronella Ltd Trial balance on 31 December 2022: Financial Accounting In Context Assignment, OU, UK

| University | The Open University (OU) |

| Subject | Financial Accounting In Context |

Question 1

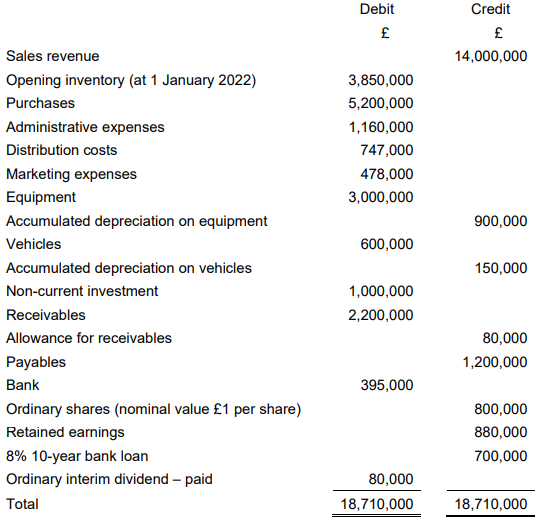

Below is the trial balance for Petronella Ltd as of 31 December 2022.

Petronella Ltd

Trial balance on 31 December 2022

The following information is relevant and not shown in the trial balance above.

- Closing inventory as of 31 December 2022 is £2,250,000.

- Irrecoverable receivables to be written off amount to £92,000.

- The allowance for receivables is to be set at 5% of net receivables at the

financial year’s end. - Petronella Ltd’s depreciation policy is as follows.

• Equipment is to be depreciated at 10% on a straight-line basis.

• Vehicles are to be depreciated at 25% on a reducing balance basis.

• No depreciation has been charged for the year ended 31 December

2022. - In October 2022, Petronella Ltd paid £60,000 of rent for the three-month period from 1 November 2022 until 31 January 2023. This amount is included in the figure for administrative expenses shown in the trial balance.

- The audit fee relating to the year ended 31 December 2022 is estimated to be £72,900. This has not been paid as of 31 December 2022.

- Irrecoverable receivables, depreciation on office equipment, marketing expenses, and audit fee are to be allocated to administrative expenses. Depreciation on vehicles is to be recorded under distribution costs.

- The 8% bank loan is repayable in ten years’ time. Interest is paid once per year and has not been paid as of 31 December 2022.

- The corporation tax rate for the year ended 31 December 2022 is 30%.

Buy Answer of This Assessment & Raise Your Grades

Question 2

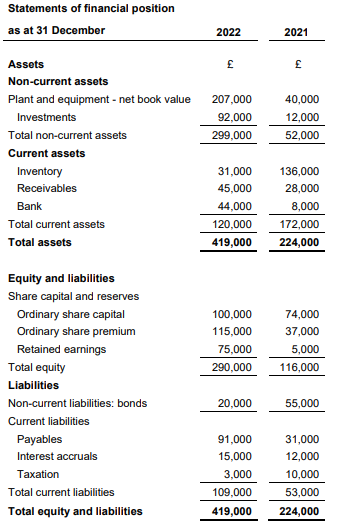

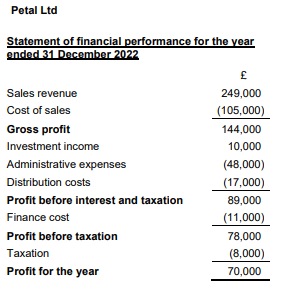

The financial statements for Petal Ltd are given below.

Petal Ltd

The following information is relevant:

- During the year, plant and equipment were sold. The equipment had originally cost £12,000 and the accumulated depreciation on the date of disposal was £5,000. The proceeds were £15,000.

- The depreciation charge for the year is £51,000.

- Investment income relates only to interest.

Do You Need Assignment of This Question

Assignment Help UK, your one-stop solution for all academic needs. Are you a UK student struggling with your university coursework? Look no further! We offer expert assignment help online and top-notch essay writing services tailored specifically for UK students. Whether you’re studying at The Open University (OU) or any other institution, we have a team of experienced professionals ready to assist you. Take advantage of our specialized assistance in subjects like Financial Accounting In Context. Don’t let deadlines and complex assignments stress you out – pay our experts to take the burden off your shoulders. Trust us to deliver high-quality solutions that will help you excel in your courses. Contact us now and experience academic success with ease.