- CIPD Level 5 5LD01 Support Informal and Self-Directed Learning Assessment Brief 2026

- Qualifi Level 7 Unit 724 Development as a Strategic Manager Assignment Brief 2026

- OTHM L5 D/650/1140 Health Education and Promoting Wellbeing Assessment Brief 2026

- BTEC Business Level 3 Unit 4 Managing an Event Assignment Task 2026

- Qualifi Level 6 BA601 Management Control Assessment Brief 2026 | UEL

- BTEC Level 4 Unit 02 Engineering Mathematics Assessment Brief 2026

- UNIT 305 Assessment Booklet: The aim of this assessment booklet is to enable managers to evidence their understanding of how to use their knowledg: Building Stakeholder Relationships Using Effective Communication, Assignment, UK

- You are working as an assistant in a small business advisory service. Esah, who wants to start her own fitness business: UNIT 7: Business Decision Making, Assignment, OC, UK

- You have recently joined a small electronic circuit manufacturing company as a quality manager: Pearsons BTEC HNC level 4 Assignment, SEC, UK

- You are working in a small engineering company as a trainer designer, and your supervisor: Egypt Assignment, OU, UK

- BTEC Level 3 Unit 13 Welding Technology Assignment Brief 2026 | Pearson Qualification

- CIPD 5HR02 Talent Management and workforce planning Assessment Questions 2026

- CIPD Level 5 5HR01 Employment Relationship Management Assessment Question 2026

- Level 5 Certificate and Diploma in Effective Coaching and Mentoring Qualification Assessment

- NVQ Level 6 Diploma Unit 604 Organisational Health and Safety Policy Assignment 2026

- Unit 3 Effective Decision Making in Adult Care Diploma Level 5 Assignment Questions 2026

- QUALIFI Level 3 BM303 An Introduction to Marketing Assignment Brief 2026 | SBTL

- 7PE617 Principles of English Language Teaching Assessment Brief 2026 | UDo

- Othm Level 3 Foundation Diploma In Health And Social Care Assignment Brief

- Level 2 Award Leadership and Team Skills Assignment 1 2026 | ILM

BB5112: The Providential Insurance Company has developed a list of seven investment alternatives, with corresponding financial factors: Business Decision Modelling Assignment, KUL, UK

| University | Kingston University(KU) |

| Subject | BB5112: Business Decision Modelling |

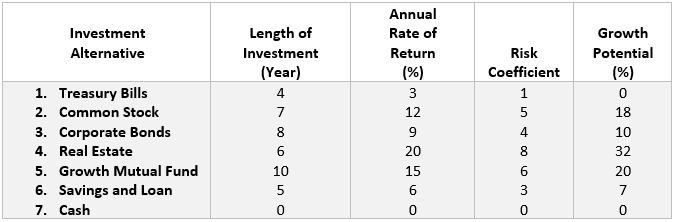

The Providential Insurance Company has developed a list of seven investment alternatives, with corresponding financial factors, for a 10-year investment horizon. These investments and their corresponding financial factors are presented in the following table. With this table, the meaning of the various financial factors is as follows:

- The length of investment – the expected number of years required for the annual rate of return to be realized, taking into account the possibility of reinvestment;

- The annual rate of return – the expected rate of return over the 10-year investment horizon;

- The risk coefficient – a subjective, dimensionless estimate representing the portfolio manager’s appraisal of the relative safety of each alternative, based on an ordinal scale of 10;

- The growth potential– a subjective estimate representing the portfolio manager’s appraisal of the potential increase in the value of the investment alternative for the 10-year period.

The Providential Insurance Company seeks to maximize the return on its portfolio of investments, subject to the following restrictions on the selection of the portfolio:

- The average length of the investment for the portfolio should not exceed 7 years

- The average risk for the portfolio should not exceed 5

- The average growth potential for the portfolio should be at least 10%

- At least 10% of all available funds must be retained in the form of cash at all times in order to maintain working capital liquidity

- The proportions of funds invested in the various alternatives must sum to 1.0.

Are You Looking for Answer of This Assignment or Essay

Task

- Using clear notation, Identify the decision variables for this problem.

- Use these decision variables to formulate the firm’s objective function, clearly stating what the objective is.

- Use the information in Tables 1 and 2 above to identify the constraints for this problem.

- Using what you have identified in 1-3 above formulate and present the complete linear programming model for this problem.

- Enter the linear programming model you have derived in 4 above into Solver to obtain the optimal solution to the problem.

- Extract the optimal solution from Solver and state the value of the objective function, and the values of the decision variables then summarise the results, making clear the contribution to the Total Rate of Return made by each investment alternative.

- Using Solver extract a Sensitivity Report for the problem.

- From the Sensitivity Report extract the slack and surplus variables and interpret their meaning.

- Using the results of the Sensitivity Report indicates whether the optimal solution to the problem is unique or if there are alternative optimal solutions.

- Present a brief interpretation of the ranging information on the objective function coefficients presented in the Sensitivity Report for this problem.

- Identify the shadow prices from the Sensitivity Report and interpret their meaning.

- Using the shadow price on the average length of investment indicates the impact on the objective function of increasing the length by 1 year. What is the upper limit of the availability of component 1 for which this shadow price is valid?

- What would be the impact of increasing the liquidity requirement by 1 percent?

Do You Need Assignment of This Question

Excel in the field of business decision modelling with Diploma Assignment Help UK. Our expert team provides comprehensive assistance and support in understanding and applying business decision modelling techniques. Learn to analyze data, make informed decisions, and optimize business outcomes. Contact us now for high-quality solutions tailored to your BB5112 assignments.