- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- ILM Level 4 Assignment 01: Developing Leadership Styles: An Action Plan for Effective Leadership and Team Engagement

- Level 6 Unit T/615/2726 Assignment: Strategic Project Management: Identifying, Planning, and Controlling Projects for Business Success

- EDD-U1-T4 Assignment: Internal and External Support Services for Educational Practitioners

- Discussion Paper on Market Forces and Government Interventions for Business Leaders

- Unit 10 Customer Relationship Management Assignment – CRM Processes & Stakeholder Roles

- CIPD 7HR02 Resourcing and Talent Management to Sustain Success

- Athe Level 3 Health and Social Care Assessment Questions

- M/618/4168 Unit 2 Principles, Values and Regulation in the Health and Social Care Sector – ATHE Level 3

- ILM Communication Skills Self-Assessment

- ILM Unit 8600-309: Understand How to Establish an Effective Team

- CMI Unit 525 Using Reflective Practice to Inform Personal and Professional Development

- Understand and Work with a Wide Range of Stakeholders and Organisational Structures – Assignment 1

- Assessment: Financial Performance Evaluation of Savory Snacks Company Ltd for Credit

- CMI L5 Assignment: Managing Stakeholder Relationships: Strategies, Challenges, and Best Practices

- Level 3 Unit 2 Assignment: Principles, Values and Regulation in the Health and Social Care Sector

- COM4006 Assignment: Introduction to Academic Skills and Professional Development

- Assessment: Managing Organisational Change: Evaluating Strategies, Challenges, and Impact

- UNIT CMI 706 Assignment: Finance for Strategic Leaders: The Role, Scope, and Impact of Finance

BA30592E: David Green is going to set up a sole trader business as a Decorator He knows that he would be personally responsible for his business’s debts: Recording Business Transaction Assignment, UOWL, UK

| University | University of the West of London( UWL) |

| Subject | BA30592E: Recording Business Transactions |

- Learning outcomes

Part A

- David Green is going to set up a sole trader business as a Decorator. He knows that he would be personally responsible for his business’s debts. He also would have some accounting responsibilities; however, he does not know about the steps for starting a business. As your area of studying is related to Business, he wants you to consult him in this matter.

- Accounting involves recording, analyzing, and summarising the transactions of an entity to provide information for decision making.

Part B

- F Polk, after being in the Bakery business for some years without keeping proper records, now decides to keep a double-entry set of books. On 1 September 2021 he establishes that his assets and liabilities are as follows: Assets: Van £5,700, Fixtures £2,800, Stock £5,200, Debtors – P Mullen £105, M Abel £311, Bank £1060, Cash £85. Liabilities: Creditors – Syme Ltd £229, A Hill £80.

He is not sure about Journal entries for the following transactions in September 2021 as follows:

- Sep 1: A debt of £105 owing from P Mullen was written off as a bad debt

- Sep 5: Office Fixtures originally bought by credit for £150 was returned to the supplier Syme Ltd., as it was unsuitable. The full allowance will be given for this.

Recording Business Transactions BA30592E - Step 10: The business is owed £311 by M. Abel. He is declared bankrupt and we only received £180 cash in full settlement of the debt.

- Sep 18: Bought a Machinery from Brown Ltd. to use in the company. The total purchasing value of the machine is £1,800. The owner paid £100 cash, £500 by issuing a cheque, and the rest of the purchasing value would remain as credit.

- Sep 26 The owner paid half of the machinery debt to Brown Ltd. by issuing a cheque.

- Sep 28: The owner paid £130 an insurance bill via cheque thinking that it was in respect of the business. We now discover that £70 of the amount paid was in fact insurance of our private house.

Do You Need Assignment of This Question

- On 1 August 2021, the owners of the ABC Enterprise, Maurice & brothers, decided that they will boldly go and keep their records on a double-entry system. Their assets and liabilities at that date were. Their assets and liabilities at that date were: office fixtures £1200, a van £32,000, and £36,800 in the bank account. They have no liabilities at the 1st of August 2021

Their transactions during August 2021 were as follows

- Aug 2 Maurice & brothers received a loan of £12,400 from Santander Bank and they deposited it in their bank account.

- Aug 3 The amount of £2800 was transferred from the Bank Account to the Cash and hand account.

- Aug 4 Bought a second-hand Van paying by cheque £6,200

- Aug 5 Bought office fixtures £3400 from Sharp Office Ltd. They paid £1000 by issuing a cheque and the rest of the value of the fixtures would remain as credit.

- Aug 8 Bought a new van on credit from Toyota Co. £8,700

- Aug 15 Bought office fixtures paying by cash £110

- Aug 19 Paid Toyota Co. a cheque for the whole amount of debt

- Aug 25 Paid £430 of the cash in hand into the bank account

- Aug 28 Bought new office fixtures paying via bank account £750

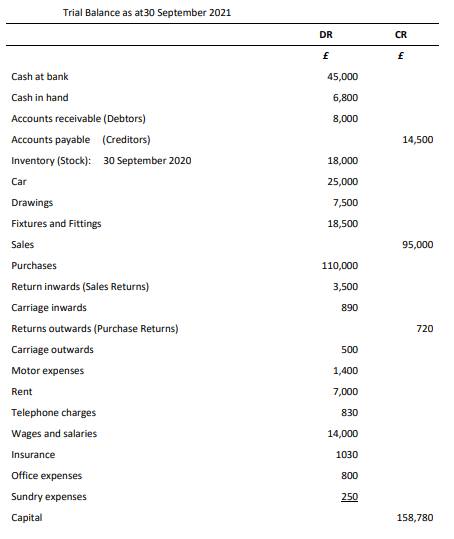

- Then balance off the accounts and extract a trial balance for sole trader B Moore. as of 30 September 2021:

Buy Answer of This Assessment & Raise Your Grades

For UK students looking for help with HND assignments, Diploma Assignment Help UK is available. Our experienced assignment writer team are all UK-based, highly qualified professionals with years of experience in providing expert HND assignment help. Our team has a wealth of knowledge and can provide the best guidance to ensure that you get the most out of your assignment. So no matter what kind of HND assignment you’re working on, our team can provide the perfect solution.

Answer