- ATHE Level 6 Unit 18 Human Resource Management Assignment Brief

- Unit CMI321 Managing Own Personal and Professional Development Assessment | BCU

- CIPD Unit 5CO01 Organisational Performance and Culture in Practice Learner Assessment Brief 2025/26

- ATHE Level 3 Unit 2 How Businesses and Organisations Work Assignment | LCPS

- Unit 531 Principles of Professional Coaching Assessment Brief | SBTL

- PSY4011 Developmental Psychology Assessment Brief – Identity Development in Childhood

- MBA7066 Innovation and Entreprenuership Assignment Brief 2024-2025 | University of Greater Manchester

- Unit 17 Caring for Individuals with Dementia BTEC Level 3 Assignment Brief Case Study

- BTEC Level 3 Unit 15 Care for Individuals with Dementia Assessment

- Unit 3: Professional Practice Authorised Assignment Brief 2025–2026, ESOFT Metro Campus

- Unit 7 Leadership & Management People Assignment – Level 3 Diploma in Business and Management

- HNC Civil Engineering Assignment 2 The Construction Environment

- HNC Civil Engineering Assignment 1 Geotechnics & Soil Mechanics Academic Year 24/25

- UNIT CMI 519 Managing Quality and Continuous Improvement Assessment Brief

- Level 5 in Leadership and Management in Adult Care – Governance and Regulatory Process in Adult Care and Decision Making in Adult Care

- BTM6GSM Global Strategic Management Level 6 Assignment 1 Case Study

- Level 5 in Leadership and Management in Adult Care – Supervising Others and Facilitate Coaching and Mentoring of Practitioners in Care Settings

- Unit 2 Marketing Processes and Planning Assignment Brief 2025-2026

- Unit 805 Strategic Communication Assignment Brief- Media Impact on International Organisations

- UNIT CMI 513 Managing Projects to Achieve Results Assessment Brief

BA30592E: David Green is going to set up a sole trader business as a Decorator He knows that he would be personally responsible for his business’s debts: Recording Business Transaction Assignment, UOWL, UK

| University | University of West London (UoWL) |

| Subject | BA30592E: Recording Business Transactions |

- Learning outcomes

Part A

- David Green is going to set up a sole trader business as a Decorator. He knows that he would be personally responsible for his business’s debts. He also would have some accounting responsibilities; however, he does not know about the steps for starting a business. As your area of study is related to Business, he wants you to consult him in this matter.

- Accounting involves recording, analyzing, and summarising the transactions of an entity to provide information for decision-making.

Part B

- F Polk, after being in the Bakery business for some years without keeping proper records, now decides to keep a double-entry set of books. On 1 September 2021, he established that his assets and liabilities are as follows: Assets: Van £5,700, Fixtures £2,800, Stock £5,200, Debtors – P Mullen £105, M Abel £311, Bank £1060, Cash £85. Liabilities: Creditors – Syme Ltd £229, A Hill £80.

He is not sure about Journal entries for the following transactions in September 2021 as follows:

- Sep 1: A debt of £105 owing from P Mullen was written off as a bad debt

- Sep 5: Office Fixtures originally bought by credit for £150 were returned to the supplier Syme Ltd., as it was unsuitable. The full allowance will be given for this.

Recording Business Transactions BA30592E - Step 10: The business is owed £311 by M. Abel. He was declared bankrupt and we only received £180 cash in full settlement of the debt.

- Sep 18: Bought Machinery from Brown Ltd. to use in the company. The total purchasing value of the machine is £1,800. The owner paid £100 cash, £500 by issuing a cheque, and the rest of the purchasing value would remain as credit.

- Sep 26 The owner paid half of the machinery debt to Brown Ltd. by issuing a cheque.

- Sep 28: The owner paid £130 an insurance bill via cheque thinking that it was in respect of the business. We now discover that £70 of the amount paid was insurance for our private house.

Do You Need Assignment of This Question

- On 1 August 2021, the owners of ABC Enterprise, Maurice & Brothers, decided that they would boldly go and keep their records on a double-entry system. Their assets and liabilities at that date were. Their assets and liabilities at that date were: office fixtures £1200, a van £32,000, and £36,800 in the bank account. They have no liabilities as of the 1st of August 2021

Their transactions during August 2021 were as follows

- Aug 2 Maurice & brothers received a loan of £12,400 from Santander Bank and they deposited it in their bank account.

- Aug 3 The amount of £2800 was transferred from the Bank Account to the Cash and hand account.

- Aug 4 Bought a second-hand Van paying by cheque £6,200

- Aug 5 Bought office fixtures for £3400 from Sharp Office Ltd. They paid £1000 by issuing a cheque and the rest of the value of the fixtures would remain as credit.

- Aug 8 Bought a new van on credit from Toyota Co. £8,700

- Aug 15 Bought office fixtures paying by cash £110

- Aug 19 Paid Toyota Co. a cheque for the whole amount of debt

- Aug 25 Paid £430 of the cash in hand into the bank account

- Aug 28 Bought new office fixtures paying via bank account £750

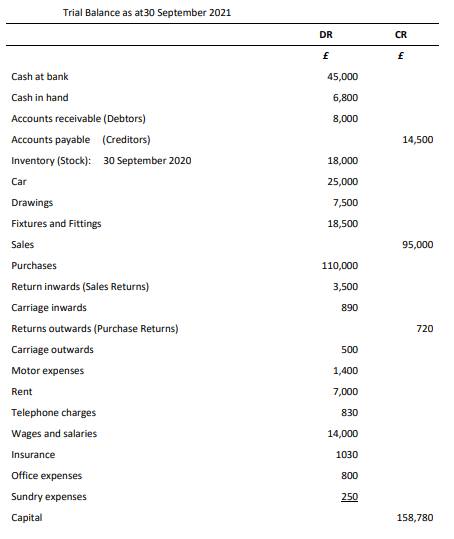

- The balance off the accounts and extract a trial balance for sole trader B Moore. as of 30 September 2021:

Buy Answer of This Assessment & Raise Your Grades

Seeking Professional Assistance for BA30592E Business Transaction Assignment? Look no further! Our team of experienced online assignment experts in the UK is here to provide top-notch Business Assignment Help services. Navigate complex topics with ease and achieve academic excellence. Partner with Diploma Assignment Help UK for comprehensive support on your University of West London (UoWL) coursework.

Answer