- EG6026 Transport Infrastructure Engineering Assignment 1 Individual Coursework | UOEL

- TEFL Assignment: Analyzing Tenses, Punctuation Usage, and Effective Teacher-Student Communication

- EEE8089 Assignment: Raspberry Pi Network Architecture and Remote Access Configuration

- ILM Unit-409: focused on understanding the impact of development on workplace performance: Managing Personal Development, Coursework, UOS, UK

- ILM Unit-409: focused on implementing and evaluating planned development activities and apply learning in the workplace: Managing Personal Development, Coursework, UOS, UK

- ILM Unit-409: focused on identifying and prioritising work-related development requirements: Managing Personal Development, CourseWork, UOS, UK

- 7PS032: Identify type of study design needed, including within or between groups where relevant: Research Methods Course Work, UOW, UK

- 7PS032: What do the means, range and standard deviations show?: Research Methods Course Work, UOW, UK

- 7PS032: You need to write a research proposal. It must be a quantitative research proposal: Research Methods Course Work, UOW, UK

- MN0493: Report the major points of your discussions with the client. This should include the construction of the portfolios: Investments and Risk Management Course Work, NUN, UK

- DAT7303: In portfolio 3, students must complete 4 tasks related to analysing a dataset using CRISP- DM methodology: Data Mining Course Work, UK

- BUSI 1475: Your task is to identify and select an article from the BBC News website (news.bbc.co.uk): Management in a Critical Context Course Work, UOG, UK

- COMP6029: Computer Science and Electronic Engineering related subjects generally use the IEEE referencing style: Network Systems Course Work, UOS, UK

- UMACTF-15-M: You have recently been appointed as a Financial Analyst for a leading investment bank in London: Corporate Financial Strategy Course Work, UWE, UK

- BAM5010: choose an organisation and make some recommendations for the delivery: Work Based Project Course Work, UOB, UK

- You are required to calculate ratios for Fresh Farms Ltd: financial Course Work, UK

- Understand the legal, ethical and theoretical context for health, safety and risk management: leadership and Management Course Work, UK

- P3 Describe the types of training and development used by a selected business: BTEC Business Extended Diploma Pearson Course Work, UK

- Describe how a selected business identifies training needs: BTEC Business Extended Diploma Pearson Course Work, UK

- Discuss your chosen business, background information and why you have chosen that business: BTEC Business Extended Diploma Pearson Course Work, UK

ACC7032: Mars Holdings Plc has a portfolio of investments in subsidiary companies and is seeking another acquisition: Managerial Finance Course Work, BCU,UK

| University | Birmingham City University (BCU) |

| Subject | Managerial Finance |

The scenario

Mars Holdings Plc has a portfolio of investments in subsidiary companies and is seeking another acquisition that complements the others.

The subsidiary companies already in the group include: machinery and commercial vehicle dealership; finance company; equipment leasing company; haulage company with a fleet of 200 heavy goods vehicles (HGV), and a chain of value hotels across the UK, one of which is making a loss.

Two possible acquisition targets have been identified:

Wire Child Ltd is based in leased converted hotels and provides care services for young people unable to be cared for in the foster system. Mars Holdings Plc are looking into the possibility of converting their failing hotel into a provider of care services and Wire Child Ltd is looking for another property to continue expanding around the UK;

Border Commercials Ltd has a large unit and caters for the storage and repair of up to 60 commercial vehicles at one time, and has the potential for more space as it is based in a large empty industrial area. Border Commercials is looking for a contract with a fleet operator to stabilize their income and growth.

Requirements

Question 1

It is to be addressed to the board of directors of Mars Holdings Plc.

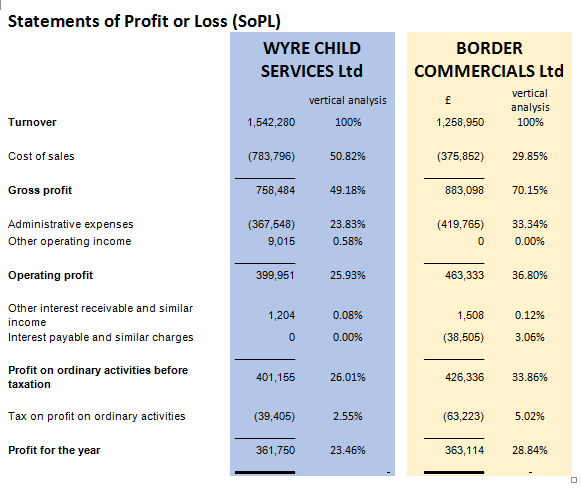

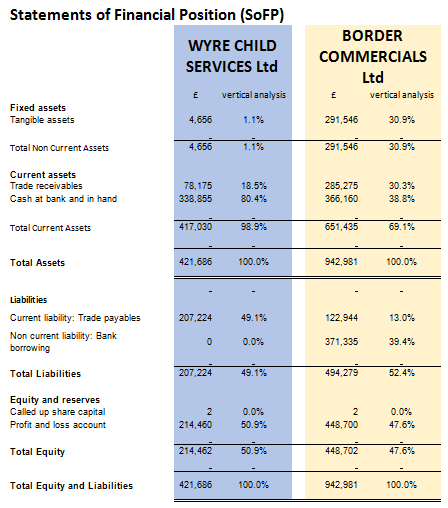

You must evaluate the financial statements, interpret the ratio analysis and make a convincing argument for investment in one of the two target companies. Your report should be supported with academic references throughout, and your ratio analysis should be put in an appendix to the report.

- Critically evaluate the working capital management (WCM) of both companies using academic references and draw conclusions on which is stronger. (200 words, 5 marks)

- Create a table that lists the advantages and disadvantages of all the finance options available to Mars Holdings Plc. Explain, with references, the source of finance you recommend as most suitable way to finance the investment in either Wire Child services Ltd or Border Commercial Ltd

Marking guide

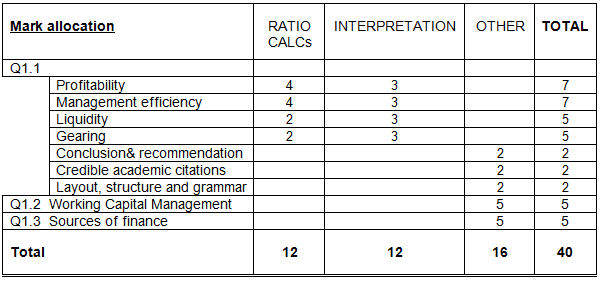

Carefully examine the marking guide below to ensure that you structure your answer to include every element:

Question 2

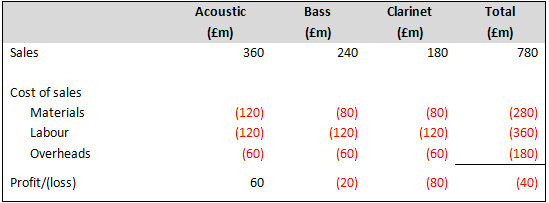

You work for a consulting firm that has been approached by a client who is concerned about the future of their business. The board of directors of AJ Supplies Ltd are considering halting the production of 2 of their products that appear to be making no profit.

As you can see from the table below the directors are considering closing products Bass and Clarinet in an effort to improve overall profitability.

You spot that management accounting would show the results differently and may affect the directors’ decision.

Question 2 (continued)

The board have approached you to get your opinion of their expansion plan, which includes a chain of factory outlet stores. Below are the figures for the first one that is planned for a central Birmingham location next year.

Company policy dictates that any decision should be based on the results of calculating Net Present Value (NPV) of 3 years cash flows using a cost of capital of 12%, Payback Period (PBP) must be less than 3 years, and the Internal Rate of Return (IRR) of the project should provide a 5% cushion in case of increases in inflation or interest rates.

The investment consists of £4,000 for the land, building costs of £7,900, and £1,830 for fittings and equipment.

The cash flows in year 1 are expected to be: total sales revenue £28,600; the cost of Acoustic products sold £7,900; Bass stock sold £5,660; staff costs £1,180; light & heat £1,676; other overheads £6,424. The cash flows for the following years are the same, but are expected to increase by 2% inflation each year.

Question 3

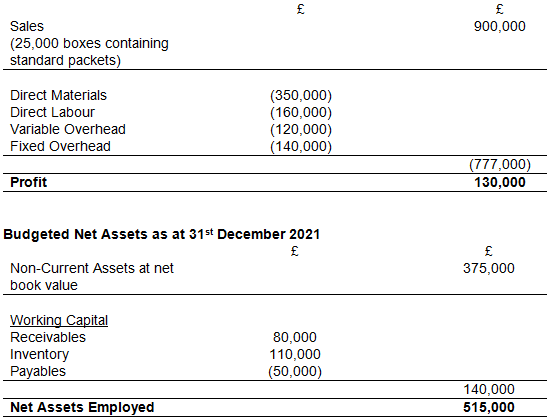

The budgeted statement of Comprehensive Income and Net Assets for GFX Industries are given below:

Budgeted Statement of Comprehensive Income For the year ended 31st December 2021

The current manufacturing facility is under-utilized and there is a proposal to extend sales to a supermarket chain with nationwide stores. However, the supermarket will sell the product under its own brand name.

Estimated effects of the proposal are;

| i. Additional annual supermarket sales of 10,000 boxes at £30 per box. |

| ii. Cost of direct materials would be reduced as a result of 8% quantity discount on all purchases and variable costs are expected to increase by 2%. |

| iii. Extra supervisory and administrative staff will be required at a cost of £20,000 per annum |

| iv. Market research has indicated that sales to existing retail outlets would fall by 10%. There will be no change in selling price to these customers. |

| v. Inventory and payables would increase by £40,000 and £25,000 respectively and the credit period extended to supermarket will be twice that allowed to existing customers. |

Required:

Prepare the revised budgets to evaluate this proposal. Specifically you should:

| a) | Prepare a revised budgeted statement of comprehensive income and a statement of net assets employed incorporating the results of the proposal i.e. Revised Sales Budget, Raw Material, Direct Labor, Variable Costs and workings. |

| b) | Calculate the effect on profit of the changes resulting from the proposal. Specifically calculate the Per Unit and Total Contribution for the old budget and the new budget. |

| c) | Advise management on the suitability of the proposal making any further calculations you consider necessary and adding any comments or reservations you think relevant. |

Are You Looking for Answer of This Assignment or Essay

Dear Birmingham City University (BCU) students in the UK, if you’re facing challenges with your Managerial Finance Course Work focused on Mars Holdings Plc and its portfolio of investments and acquisitions, we’re here to assist you. Our dedicated team offers top-tier assignment writing service UK and specializes in Case Study Writing Help tailored to your academic needs. Don’t let complex financial topics hinder your progress. Invest in our services and ensure your success in this course. With our expert guidance, you’ll navigate your academic journey with confidence. Pay our professionals today to secure your path to academic excellence!