- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- ILM Level 4 Assignment 01: Developing Leadership Styles: An Action Plan for Effective Leadership and Team Engagement

- Level 6 Unit T/615/2726 Assignment: Strategic Project Management: Identifying, Planning, and Controlling Projects for Business Success

- EDD-U1-T4 Assignment: Internal and External Support Services for Educational Practitioners

- Discussion Paper on Market Forces and Government Interventions for Business Leaders

- Unit 10 Customer Relationship Management Assignment – CRM Processes & Stakeholder Roles

- CIPD 7HR02 Resourcing and Talent Management to Sustain Success

- Athe Level 3 Health and Social Care Assessment Questions

- M/618/4168 Unit 2 Principles, Values and Regulation in the Health and Social Care Sector – ATHE Level 3

- ILM Communication Skills Self-Assessment

- ILM Unit 8600-309: Understand How to Establish an Effective Team

- CMI Unit 525 Using Reflective Practice to Inform Personal and Professional Development

- Understand and Work with a Wide Range of Stakeholders and Organisational Structures – Assignment 1

- Assessment: Financial Performance Evaluation of Savory Snacks Company Ltd for Credit

- CMI L5 Assignment: Managing Stakeholder Relationships: Strategies, Challenges, and Best Practices

- Level 3 Unit 2 Assignment: Principles, Values and Regulation in the Health and Social Care Sector

- COM4006 Assignment: Introduction to Academic Skills and Professional Development

- Assessment: Managing Organisational Change: Evaluating Strategies, Challenges, and Impact

- UNIT CMI 706 Assignment: Finance for Strategic Leaders: The Role, Scope, and Impact of Finance

Unit 10 Journal Entries, Ledgers & Trial Balance Examples

| University | University of South Wales (USW) |

| Subject | Unit 10 Financial Recording And Accounting |

Question 1:

The Barron Company is a merchandising firm. The company also rents out extra office space to Paley

Company. The following events occurred during the month of January 2002, the first month of

operations.

Transactions:

1 Received $100,000 cash as new stockholder investments.

4 Purchased inventory costing $12,000 on account from Elrod Company.

5 Purchased office supplies for $600 cash.

8 Sold merchandise costing $5,000 for $9,000 to Gray Company on account.

9 Paid employee salaries of $3,000.

10 Received payment in full from Gray Company.

11 Purchased inventory for $60,000 cash.

12 Sold inventory for $18,000 cash.

13 Paid Elrod Company the full amount due.

18 Purchased a building for $20,000 cash and a $160,000, 12% mortgage note payable. The first

payment of $1,920 is due in February.

19 The company received $6,000 for 3 months rent from the Paley Company.

20 The company paid $12,000 for a 1-year fire insurance policy.

21 The company sold inventory costing $50,000 to various credit customers on account for

$90,000.

22 Declared and paid dividends of $10,000.

Do You Need Assignment of This Question

Question 2:

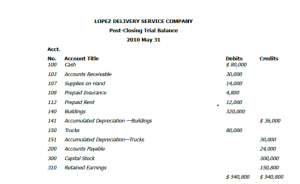

Lopez Delivery Service Company has the following chart of accounts:

| Acct. No. | Account Title | Acct. No. | Account Title |

|---|---|---|---|

| 100 | Cash | 310 | Retained Earnings |

| 103 | Accounts Receivable | 320 | Dividends |

| 107 | Supplies on Hand | 400 | Service Revenue |

| 108 | Prepaid Insurance | 507 | Salaries Expense |

| 112 | Prepaid Rent | 511 | Utilities Expense |

| 140 | Buildings | 512 | Insurance Expense |

| 141 | Accumulated Depreciation—Buildings | 515 | Rent Expense |

| 150 | Trucks | 518 | Supplies Expense |

| 151 | Accumulated Depreciation—Trucks | 520 | Depreciation Expense—Buildings |

| 200 | Accounts Payable | 521 | Depreciation Expense—Trucks |

| 206 | Salaries Payable | 568 | Miscellaneous Expense |

| 300 | Capital Stock |

The post-closing trial balance as of 2010 May 31, was as follows:

The transactions for June 2010 were as follows:

June 1 Performed delivery services for customers on account, USD 60,000.

3 Paid dividends, USD 10,000.

4 Purchased a USD 20,000 truck on account.

7 Collected USD 22,000 of the accounts receivable.

8 Paid USD 16,000 of the accounts payable.

11 Purchased USD 4,000 of supplies on account.

17 Performed delivery services for cash, USD 32,000.

20 Paid the utilities bills for June, USD 1,200.

23 Paid miscellaneous expenses for June, USD 600.

28 Paid salaries of USD 28,000 for June.

Buy Answer of This Assessment & Raise Your Grades

Question 3

The “use your first and last name as company name” Company is a merchandising firm. The

company also rents out extra office space to various tenants. The following events occurred

during the month of January 2002, the first month of operations.

1. Record these entries in the general journal and post to ledger.

2. Prepare the adjusting entries and Prepare final Accounts

Transactions:

1. Ten investors formed the company by paying a total of $500,000 cash for common stock.

2. Purchased land by signing a 5-year, 6% note payable in the amount of $100,000.

3. Purchased a building for $200,000 cash.

4. Purchased furniture and fixtures for $10,000 on account.

5. Purchased equipment for $20,000 cash.

6. Purchased inventory for $100,000 on account.

7. Paid $12,000 to rent storage space for 3 months.

8. Paid $3,600 for 3 years insurance.

9. Collected $15,000 from tenants for 3 months’ rent in advance.

10. Sold inventory for $140,000 on account. The inventory originally cost $80,000.

11. Paid $50,000 on accounts payable.

12. Collected $100,000 from customers.

13. Loaned $10,000 to a customer on a 6-month, 12% note.

14. Declared and paid dividends of $2,000.

15. Paid salaries of $10,000 for the month.

16. Purchased supplies for $2,000 on account.

17. Paid $600 cash for repairs on equipment.

18. Paid $1,500 for advertising.

19. Paid $500 for utilities.

Are You Looking for Answer of This Assignment or Essay

Assessment Criteria

P1 Record double entry bookkeeping transactions in a timely and accurate way.

P2 Apply a range of business transactions using double entry bookkeeping, journals and ledgers.

M1 Analyse a range of business transactions using double entry, journals and ledgers in order to provide

accurate and timely accounting information.

P3 Using data provided, extract ledger balances into a trial balance for an organisation to accurately

record transactions.

M2 (For M2 suppose the trail balance has 4 different errors) Interpret, identify and correct accounting

errors through the production of a trial balance to ensure accurate accounting records.

For D1 and D2, you have to visit an actual business and conduct systematic gathering, summarizing

and recording of business transactions for accurate reporting of organisational efficiency and performance

(D1). Also produce a trial balance that is timely, accurate and fully compliant for an organisation to meet

its objectives (D2).