- ATHE Level 6 Unit 2: Assesses the impact of leadership and management skills and behaviours : Personal Leadership and Management Development Assignment, UK

- QUALIFI Level 5 Part 02 Unit 9500: A pilot Research Project is the small scale research project that is intended to highlight the pros: Research Project, UK

- QUALIFI Level 5 Part 01 Unit 9500: Research Project, UK Professional Development Academy

- You are to prepare a discussion paper aimed at the group of middle managers in your organisation : Personal Leadership and development, Assignment, UK

- Critically analyse the environment facing YourOrg, and identify the central issues confronting YourOrg resulting : Strategic Management Assignment , CMU, UK

- Unit 15: This assignment requires you to analyse, design, develop, and evaluate an Internet of Things (IoT) application: Transport Network Design (L5), Assignment BTEC, UK

- Clearly differentiate the terms organisational mission, vision and strategy: Strategic Leadership And Management In Context, Assignment, UK

- ATHE Level 7 : Understand the importance of financial data in formulating and delivering business strategy : Finance for Strategic Managers, Assignment UK

- CMI Unit 703 : Collaboration and partnerships can turn ideas into reality, enhancing opportunities for innovation and creativity, research and development : Collaboration and Partnerships, Assignment, UK

- 7OS01- Explain how the Employment Tribunal, the County Court, The Health and Safety Executive and the Information Commissioner : Advanced employment law in practice, Assignment, UK

- ILM 308 – Describe the factors that will influence the choice of leadership styles or behaviours in workplace situations: Understanding Leadership Level 3 Assignment , UK

- Level 5 CMI Unit 526 – Mark Sheet: Principles of Leadership Practice, UK

- Level 5 CMI Unit 526 : Understanding of ethical leadership and the impact of culture and values on leadership- Principles of Leadership Practice, Assignment, UK

- CMI Unit 501: Examine the impact of legal status on the governance of an organisation- Principles Of Management And Leadership In An Organisational Context Level 5 Assignment, UK

- ILM Level 5 Effective Communication Skills, Assignment , UK

- ILM Level 3 – Describe the factors that will influence the choice of leadership styles or behaviours in workplace situations Referral : Understanding Leadership styles, Assignment, UK

- CMI Unit 502 Understand approaches to developing, managing, and leading teams: Principles of Developing, Managing and Leading Individuals and Teams to Achieve Success, Assignment, UK

- R033 Supporting individuals through life events, Set Assignment, OCR, UK

- Working in partnership in health and social care, Assignment, UK

- CMI Unit 5034 Problem solving tools and techniques for consultants, Assignment, UK

You are a junior accountant in a small accountancy firm and you have been asked to prepare and produce a range of final accounts: Financial Accounting Assignment, CTIC,UK

| University | Chindwin Tu International College (CTIC) |

| Subject | Financial Accounting |

Scenario

You are a junior accountant in a small accountancy firm and you have been asked to prepare and produce a range of final accounts for a number of different businesses. You have been provided with a range of individual company’s financial details from which to create a general ledger, a trial balance, income statement and balance sheet. You will need to make adjustments as required and once the general ledger is completed. Once completed you will present to your line manager a portfolio of final accounts that includes a reflective summary that compares the different types of accounts produced.

You should cover the following in the introduction:

- What is financial accounting.

- Explain the difference between accounting and book-keeping.

- What is a business transaction?

Part 1

Record business transactions using double-entry book-keeping, and be able to extract a trial balance.

- 1, 2020, Mr Mason Brown started business with Cash $40,000.

- 3, he paid into the Bank $2,000.

- 5, he purchased goods for cash $15,000.

- 8, he sold goods for cash $6,000.

- 10, he purchased furniture and paid by cheque $5,000.

- 12, he sold goods to Mary $4,000 by credit.

- 14, he purchased goods from John $10,000.

- 15, he returned goods to John $5,000.

- 16, he received from Mary $3,960 in full settlement.

- 18, he withdrew goods for personal use $1,000.

- 20, he withdrew cash from business for personal use $2,000.

- 24, he paid telephone charges $1,000.

- 26, cash paid to John in full settlement $4,900.

- 31, paid for stationary $200, rent $ 500 and salaries to staff $2,000.\

Required;

- Apply the double entry book-keeping system of debits and credits. Record sales and purchases transactions in journal and a general ledger for the year 31 Dec 2020.

- Produce a trial balance as at 31 Dec 2020 by applying the use of the balance off rule to complete the ledger.

- Analyse sales and purchase transactions to compile a trial balance using double entry bookkeeping appropriately and effectively.

- Apply trial balance figures to show which statement of financial accounts they will end up in.

Part 2

Prepare final accounts for sole-traders, partnerships and limited companies in accordance with appropriate principles, conventions and standards.

Prepare final accounts for sole-traders

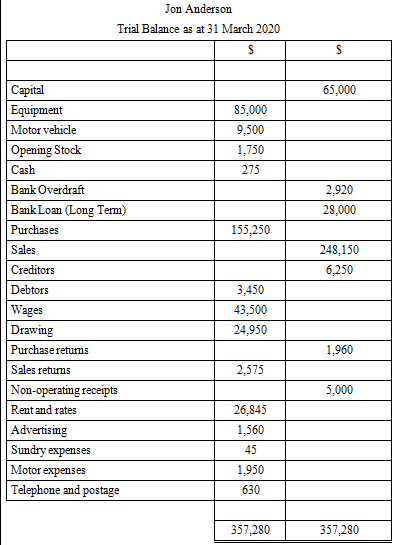

The following trial balance was extracted from the books of Jon Anderson, a sole trader at the close of the business on 31 March 2020.

Prepare a trading, profit and loss and appropriation account for the year and a balance sheet as at the end of the year for a sole trader. Take the following into account:

Addition Information:

Closing Stock $2,350

Depreciation on Straight-line Method Basis

Equipment 15% on Cost

Motor Vehicle 20% on Cost

Do You Need Assignment of This Question

Prepare final accounts for Partnerships

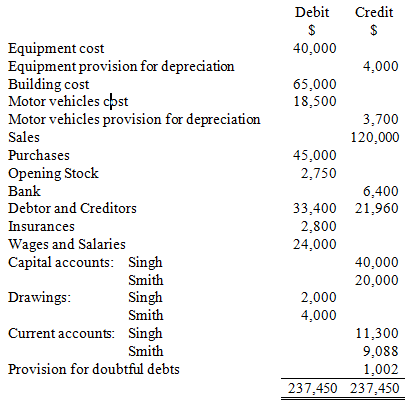

Mrs. Singh and Mr. Smith are in partnership and share profits and losses 2:1. A draft Trial Balance has been extracted from the partnership books of account at the end of the year, 31 December 2020

There are a number of items that need to be taken into consideration

- Depreciation is to be provided at 10% straight-line on equipment and 25% reducing balance on motor vehicles

- Closing stock is valued at $3,000.

- Insurance of $400 is prepaid and wages of $800 are to be accrued.

- The provision for doubtful debts is to be increased to 5% of debtors.

- Interest on drawings is charged at 5% p.a. on the balance in the trial balance.

- Interest on capital is allowed at 7%.

- Smith receives a salary of $4,000.

Required :

Prepare the Partnership Trading and Profit & Loss Account for the year ended, the Partnership Appropriation Account for the year ended and the Partners’ Current Accounts at 31 December 2020.

Prepare final accounts for Limited company

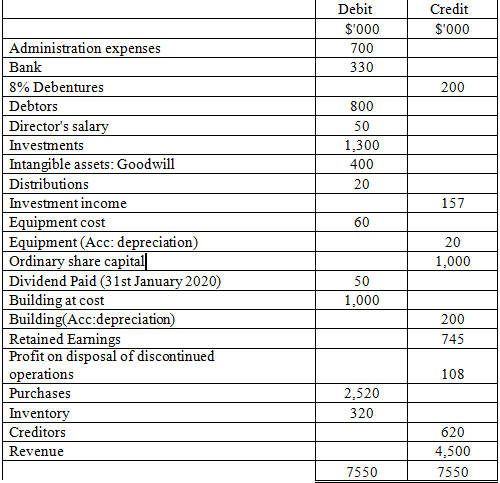

You are a business manager with Walker Brother Limited, a sportswear manufacturer producing mainly running wear. Your director has asked you to produce the draft financial statements for the year ended 31 July 2020, based on the trail balance below, which have been extracted from the accounting system and the information in the notes to the accounts.

Trial Balance for Walker Brother Limited at 31 July 2020

Notes to the accounts

- Inventory at 31 July 2020 was valued at $250,000.

- The following expenses were still outstanding

Administration costs $2,000

Director’s salary $6,000

- The Distribution costs include a prepayment $3,000 relating to the following year.

- Depreciation is to be charged on:

Building $100,000

Equipment $8,000

- Corporation tax charge on profits for the year is estimates to be $ 95,000

- Debenture interest is outstanding at the year-end.

Required:

- You are required to produce finals account Income Statement and Balance Sheet for Walker Brother Limited at 31 July 2020

- Make adjustments to balances of sum accounts for example, accruals, depreciation and prepayments before preparing the final accounts.

Compare the essential features of each financial account statement to analyze the differences between them in terms purpose, structure and content.

Do You Need Assignment of This Question

Hello Chindwin Tu International College (CTIC) students in the UK! If you’re facing challenges with your Financial Accounting Assignment, and require expert assistance in preparing final accounts, we’re here to support you. Our dedicated team of assignment helper UK experts specializes in Finance Assignment Help UK, tailored to meet your academic requirements. Don’t let the complexities of financial accounting hold you back. Invest in our services and ensure your success in the course. With our help, you can confidently navigate your academic journey and excel in your studies. Pay our experts today and secure your academic success!