- Assessment: Financial Performance Evaluation of Savory Snacks Company Ltd for Credit

- CMI L5 Assignment: Managing Stakeholder Relationships: Strategies, Challenges, and Best Practices

- Level 3 Unit 2 Assignment: Principles, Values and Regulation in the Health and Social Care Sector

- COM4006 Assignment: Introduction to Academic Skills and Professional Development

- Assessment: Managing Organisational Change: Evaluating Strategies, Challenges, and Impact

- UNIT CMI 706 Assignment: Finance for Strategic Leaders: The Role, Scope, and Impact of Finance

- ENGINEERING DESIGN TMA2 v1: CAD Design Report: Specification, Evaluation & Drawings

- Unit CMI 514 Assignment: Analysis of Organisational Change: Managing Change

- EMS402U TMA1: Engineering Design Solutions: Concept Development & Assessment

- LEVEL 3 UNIT 31: Effective Project Management (International BTEC )

- ILM Level 4 ASSIGNMENT: Managing equality and diversity in own area

- CMI 504 Assessment: The Rationale For Managing Performance Within Organisations

- Level 7 Unit 03 Assignment: Leading a Strategic Management and Leadership

- LO:01, LO:02 (MSCCO01) Managing Innovation and Change in Computing

- CMI Level 6 Certificate in Professional Management and Leadership

- Financial Accounting: Double-Entry Bookkeeping, Journals, Ledgers, and Trial Balance Preparation

- Assignment 1: Understand and Work with a Wide Range of Stakeholders and Organisational Structures

- CMI 526 Assessment: Principles of Leadership Practice

- Promoting Health, Wellbeing, and Inclusive Care in Health and Social Care Settings

- MID4022 Legal and Ethical Professional Principle in Midwifery

ACFI3422: Keener Ltd is a UK company that manufactures water bottles, it is one of the largest suppliers of these water bottles in the UK today: Liquidity and Risk Assignment, DMU, UK

| University | De Montfort University (DMU) |

| Subject | ACFI3422: Liquidity and Risk |

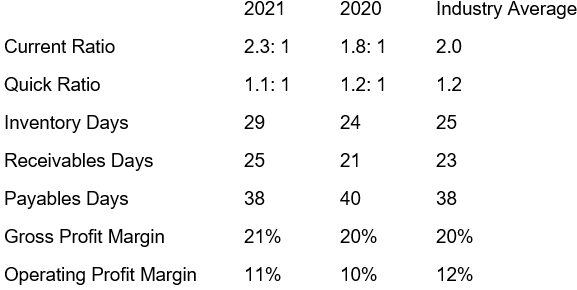

Keener Ltd is a UK company that manufactures water bottles, it is one of the largest suppliers of these water bottles in the UK today. It has a year-end of 30th of November. The liquidity ratios have been calculated for the previous 2 years: –

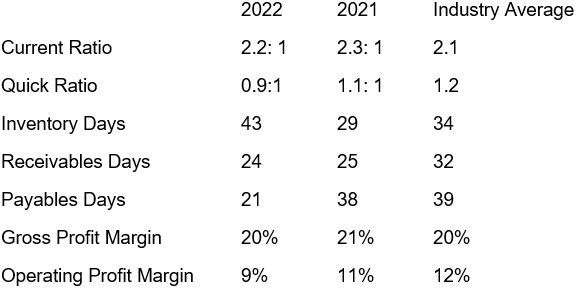

Keener has forecast the following for the year ended 30th of November 2022:

Credit management

Sales to increase to £8 million for the year to come.

Receivables are forecast to be £1,150,000.

The cost of financing receivables is covered by an overdraft at the interest rate of 5% p.a.

Keener is now considering offering a cash discount of 0.5% for payment of debts within 20 days. It is expected that 25% of customers will take up the discount.

Inventory management

Keener is also trying to find the optimum order quantity for its inventory. The monthly demand for its inventory which costs £2.30 per unit is 80,000 units per month. The cost per order is currently £1.25. The holding cost of 1 unit p.a. is £1.

Keener’s suppliers have offered a discount of 0.5% per unit for orders of 2,000 units or more.

Do You Need Assignment of This Question

Cash management

Keener has a constant demand for cash totaling £5,000,000 p.a. It can replenish its current account by selling a constant amount of gilts which are held as an investment earning 3% p.a. The cost per sale of gilts is a fixed £8 per sale.

The management of Keener has also considered using the Miller-Orr model of cash management. They have considered a lower limit of £1,000,000, the standard deviation of the daily cash flows is £40,000 and it will cost £12 per transaction to transfer money to or from the bank. The interest rate is 3% p.a.

Unseen material

Keener has forecast the following for the year ended, 30th of November 2023:

Credit management

Sales are forecast to be £8.85m for the year ahead.

Receivables are forecast to be £1,010,000.

The cost of financing receivables remains the same.

Inventory management

Monthly demand for its inventory remains the same but the cost has increased to £2.65 per unit. The cost per order has increased to £1.48. The storage cost of 1 unit p.a. is £0.55.

Cash management

All details remain the same, except the annual demand for cash is now £6,350,000.

Are You Looking for Answer of This Assignment or Essay

Tasks for evaluation

The managers of Keener want you to evaluate the company’s liquidity position. To help you to do this, consider the following:

Section A – Calculations

Calculate the following: –

- The benefit (or otherwise) of offering a discount of 0.23% for payment of the debt within 16 days. Take up for this discount is predicted to be 27%.

- The optimum quantity of inventory to order is if the suppliers now offer a discount of 0.30% per unit for orders of 2,600 units or more. Keener’s Cost of Capital is 17%.

- The lower limit, upper limit, and return point (from the Miller-Orr model) for Keener if the standard deviation of cash flows is £42,000 per day and briefly explain how this approach works.

Section B – Evaluation

- Using the working capital ratios for 2021 and 2022 critically evaluate the liquidity position of Keener.

- If Keener was facing a cash flow problem, critically evaluate whether they should enter a factoring arrangement, instead of offering an early payment discount.

- Explain how the one-bin and two-bin systems work and evaluate the advantages and disadvantages of each system.

In places where diagrams would assist your answer, they should be used. Any words used to label the diagrams are excluded from the word count.

Do You Need Assignment of This Question

Seeking University Assignment Help for your ACFI3422: Liquidity and Risk assignment at De Montfort University (DMU)? Look no further than Diploma Assignment Help UK. Our website offers assistance from online assignment writers who possess expertise in liquidity and risk analysis. With a focus on quality and timely delivery, we guarantee customized solutions that meet the highest academic standards.