- NVQ Unit 2 Manage Personal and Professional Development Assignment

- ATHE Level 6 Unit 18 Human Resource Management Assignment Brief

- Unit CMI321 Managing Own Personal and Professional Development Assessment | BCU

- CIPD Unit 5CO01 Organisational Performance and Culture in Practice Learner Assessment Brief 2025/26

- ATHE Level 3 Unit 2 How Businesses and Organisations Work Assignment | LCPS

- Unit 531 Principles of Professional Coaching Assessment Brief | SBTL

- PSY4011 Developmental Psychology Assessment Brief – Identity Development in Childhood

- MBA7066 Innovation and Entreprenuership Assignment Brief 2024-2025 | University of Greater Manchester

- Unit 17 Caring for Individuals with Dementia BTEC Level 3 Assignment Brief Case Study

- BTEC Level 3 Unit 15 Care for Individuals with Dementia Assessment

- Unit 3: Professional Practice Authorised Assignment Brief 2025–2026, ESOFT Metro Campus

- Unit 7 Leadership & Management People Assignment – Level 3 Diploma in Business and Management

- HNC Civil Engineering Assignment 2 The Construction Environment

- HNC Civil Engineering Assignment 1 Geotechnics & Soil Mechanics Academic Year 24/25

- UNIT CMI 519 Managing Quality and Continuous Improvement Assessment Brief

- Level 5 in Leadership and Management in Adult Care – Governance and Regulatory Process in Adult Care and Decision Making in Adult Care

- BTM6GSM Global Strategic Management Level 6 Assignment 1 Case Study

- Level 5 in Leadership and Management in Adult Care – Supervising Others and Facilitate Coaching and Mentoring of Practitioners in Care Settings

- Unit 2 Marketing Processes and Planning Assignment Brief 2025-2026

- Unit 805 Strategic Communication Assignment Brief- Media Impact on International Organisations

Below is the trial balance for Petronella Ltd as of 31 December 2022. Petronella Ltd Trial balance on 31 December 2022: Financial Accounting In Context Assignment, OU, UK

| University | The Open University (OU) |

| Subject | Financial Accounting In Context |

Question 1

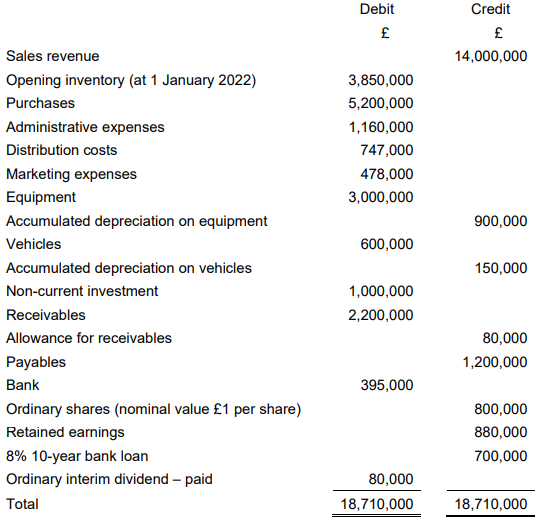

Below is the trial balance for Petronella Ltd as of 31 December 2022.

Petronella Ltd

Trial balance on 31 December 2022

The following information is relevant and not shown in the trial balance above.

- Closing inventory as of 31 December 2022 is £2,250,000.

- Irrecoverable receivables to be written off amount to £92,000.

- The allowance for receivables is to be set at 5% of net receivables at the

financial year’s end. - Petronella Ltd’s depreciation policy is as follows.

• Equipment is to be depreciated at 10% on a straight-line basis.

• Vehicles are to be depreciated at 25% on a reducing balance basis.

• No depreciation has been charged for the year ended 31 December

2022. - In October 2022, Petronella Ltd paid £60,000 of rent for the three-month period from 1 November 2022 until 31 January 2023. This amount is included in the figure for administrative expenses shown in the trial balance.

- The audit fee relating to the year ended 31 December 2022 is estimated to be £72,900. This has not been paid as of 31 December 2022.

- Irrecoverable receivables, depreciation on office equipment, marketing expenses, and audit fee are to be allocated to administrative expenses. Depreciation on vehicles is to be recorded under distribution costs.

- The 8% bank loan is repayable in ten years’ time. Interest is paid once per year and has not been paid as of 31 December 2022.

- The corporation tax rate for the year ended 31 December 2022 is 30%.

Buy Answer of This Assessment & Raise Your Grades

Question 2

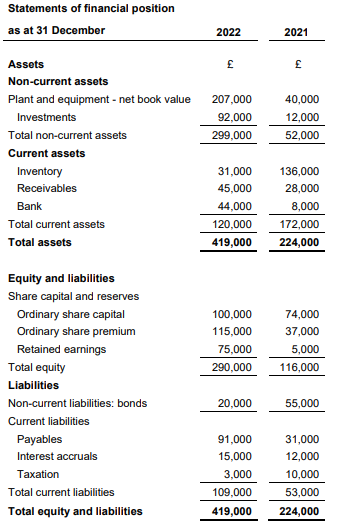

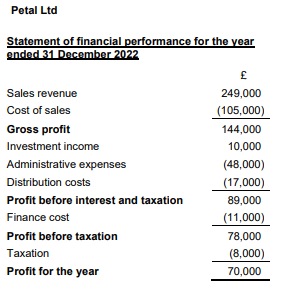

The financial statements for Petal Ltd are given below.

Petal Ltd

The following information is relevant:

- During the year, plant and equipment were sold. The equipment had originally cost £12,000 and the accumulated depreciation on the date of disposal was £5,000. The proceeds were £15,000.

- The depreciation charge for the year is £51,000.

- Investment income relates only to interest.

Do You Need Assignment of This Question

Assignment Help UK, your one-stop solution for all academic needs. Are you a UK student struggling with your university coursework? Look no further! We offer expert assignment help online and top-notch essay writing services tailored specifically for UK students. Whether you’re studying at The Open University (OU) or any other institution, we have a team of experienced professionals ready to assist you. Take advantage of our specialized assistance in subjects like Financial Accounting In Context. Don’t let deadlines and complex assignments stress you out – pay our experts to take the burden off your shoulders. Trust us to deliver high-quality solutions that will help you excel in your courses. Contact us now and experience academic success with ease.